Tonight while watching my favorite show, Jim Cramer’s I Will Lose Your Money, he was suggesting this year is nothing like the last. His analysis as always is nothing less than comical. Before I bring up the strong supporting evidence for my argument, merely refer to Another Greeceful Weekend to understand my disdain for Jim Cramer.

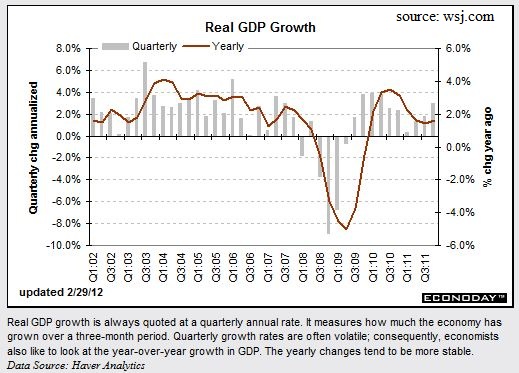

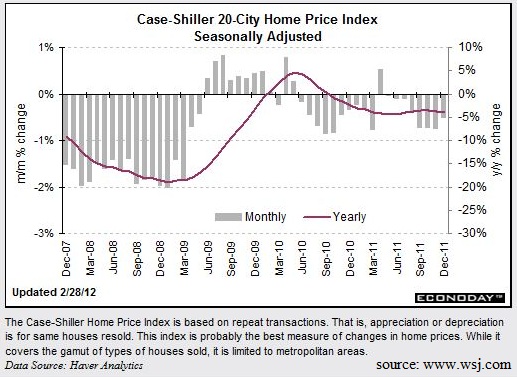

Now to the meat of the presentation. Below are two images and you are tasked to decipher which is 2011 and which is 2012.

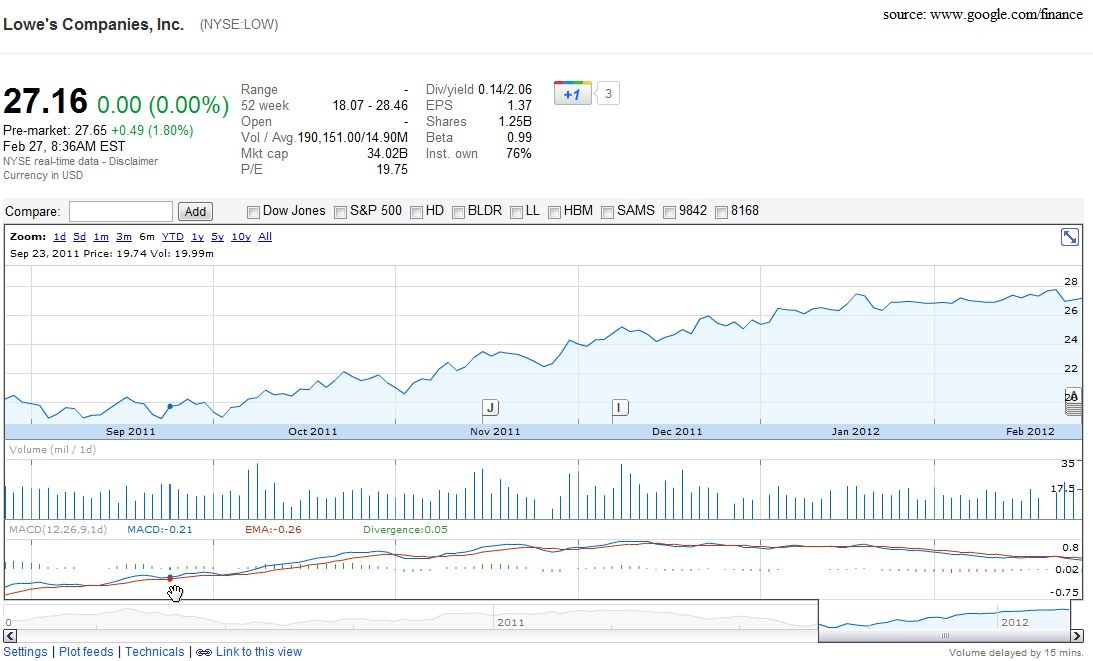

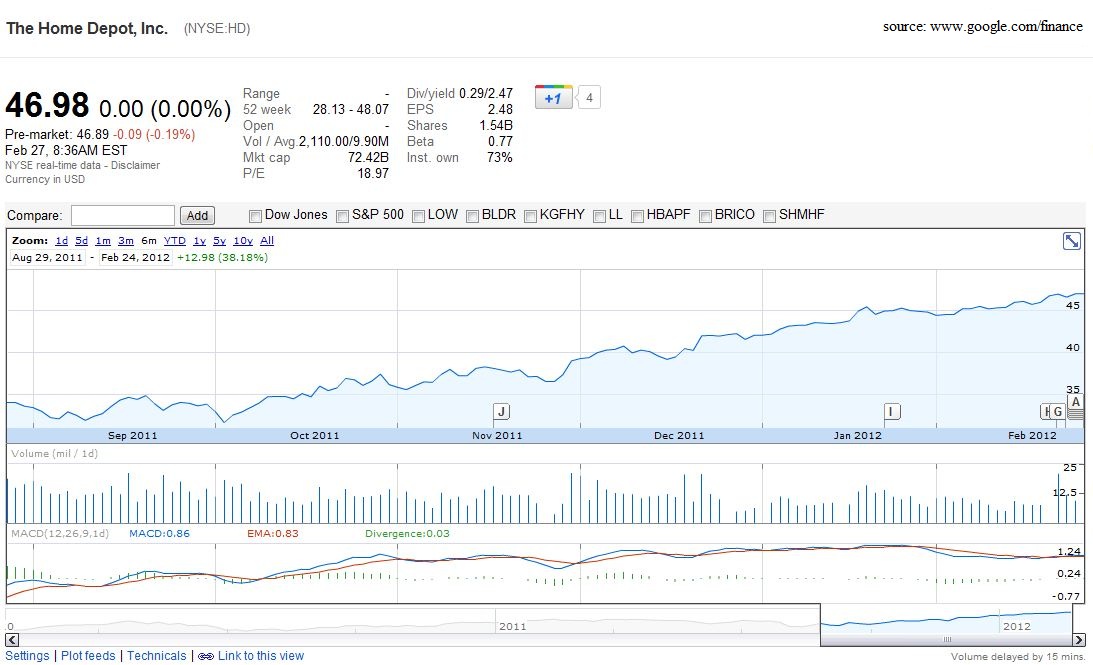

Yes real GDP is better; In comparison to what? To make the argument that things are better when the comparisons are based on the great recession is ridiculous. Things are better, yes. Are things perfect? No they are not, in fact they are not even decent. The durable good number speaks for itself, this cold hard number suggests thinks aren’t perfect. For the market to keep headed higher at these rates in spite of gas, in spite of horrible home prices, and in spite of the European recession is just comical at this point. The markets have come up hard and fast. When the market stops brushing off the bad news because it’s so bad it has to sink in, we will go back the other way as quick as we did last year. For those reading this suggesting that I haven’t brought up jobless claims, housing, or so on. You are correct, the average readers time span has elapsed and my point has been clearly made and does not need any further support.

“Don’t be afraid to see what you see.” – Ronald Reagan