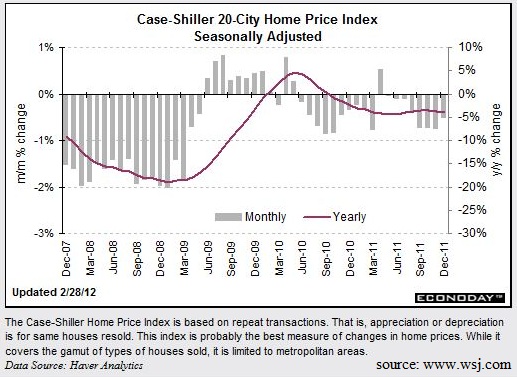

As February draws to a close, take a look at the last three months shown below.

Things have seemed substantially better since December. Everything from jobs to housing…. Wait was that about housing?

Supply has been declining, but prices have not been improving. This suggests either a decrease in demand or a real underlying issue (housing has not bottomed).

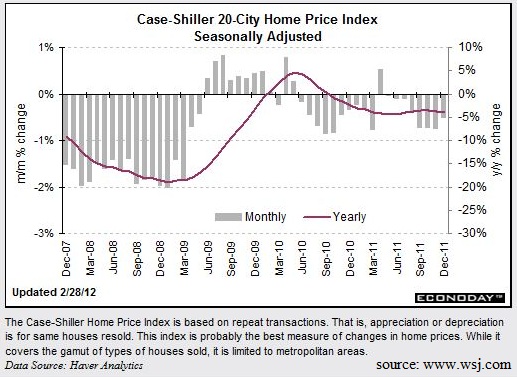

Remember last year when we were all tricked into everything being better? Well it seems the trickster has just changed its name from housing to jobs. Below is the S&P from last year. Investors seem to have forgotten the market can go down. Below shows that the market can decline and do so very rapidly.

S&P 2011

Investors have forgotten that a calendar year has 12 months. We are merely two months in. With so much of the year still unknown and having come so far, this momentum cannot be sustained. As the recent home data has been hinting at, things are not 100% better. This correlates to your returns in 2011 not being 100%. Hate to be the bearer of bad news, but things are likely to get worse before they get better. It seems investors are counting their chickens before they hatch, and in reality 2012 has 10 more months to play out. Beware that 2012 sounds more and more like 2011 and as we all know history has a tendency to repeat itself.

“The Truth is incontrovertible. Malice may attack it, ignorance may deride it, but in the end, there it is.” – Winston Churchill