Both Lowe’s and Home Depot report a good quarter supporting the story of housing recovery. The true reason that the winter quarter was good for these companies was renovations. Americans have quit moving out of their homes and instead have been upgrading aggressively. The previous statement does not suggest a housing recovery, but instead a fear of Americans getting back into the housing market. Gary Balter a Credit Suisse analyst states: “We encourage investors to look past the near term and think about double-digit margins for all when housing recovers.” Not only is he wrong, he is dead wrong. My Anything But Housingarticle brought attention to the massive revisions downward of existing home sales, which don’t bode well for the housing recovery. If homes aren’t moving, then the good numbers of Lowe’s and Home Depot are merely suggesting mom and pop upgrading their kitchen or bath.

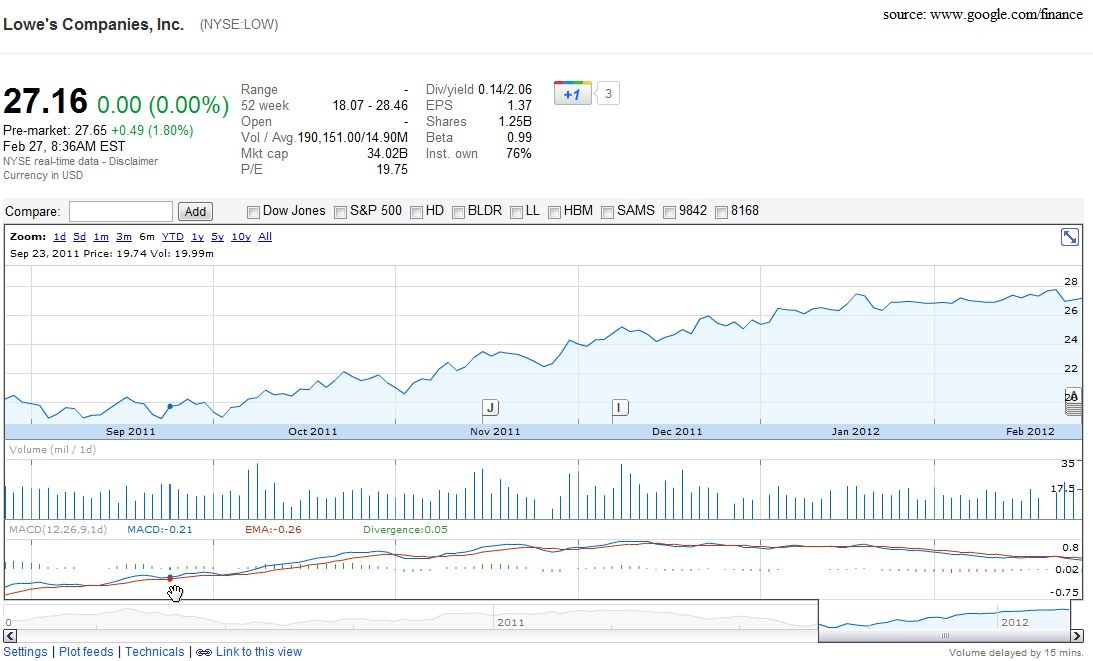

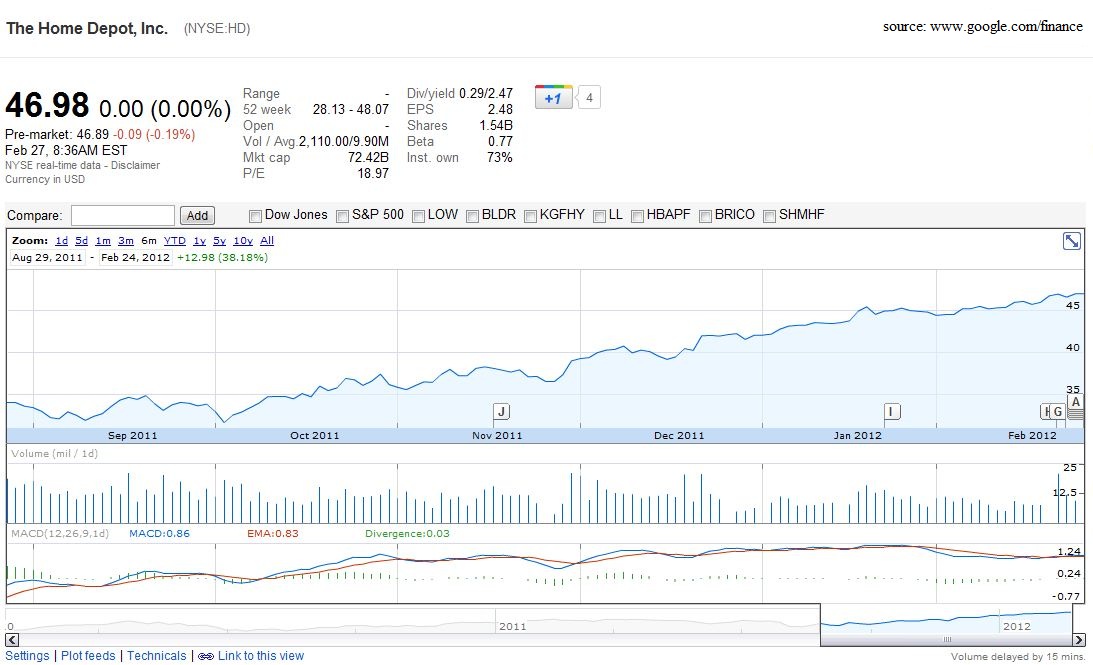

Where do these stocks go from here? If you are a believer in the housing bottom and full fledged recovery, then these stocks are going to double and we are going to Dow 17,000. In the real world where fear finally slips back into this market, these stocks could be risky. The good housing data that has been coming out since the beginning of the year will turn negative sooner then later. As we saw last week the numbers are no longer stellar and this suggests the housing bottom may not be here yet. If the housing data turns negative, these stocks will be hit the hardest. Both Lowe’s and Home Depot have had stellar runs in the past 6 months and they may have gotten substantially ahead of themselves.

“No matter how great the talent or efforts, some things just take time. You can’t produce a baby in one month by getting nine women pregnant.” – Warren Buffett