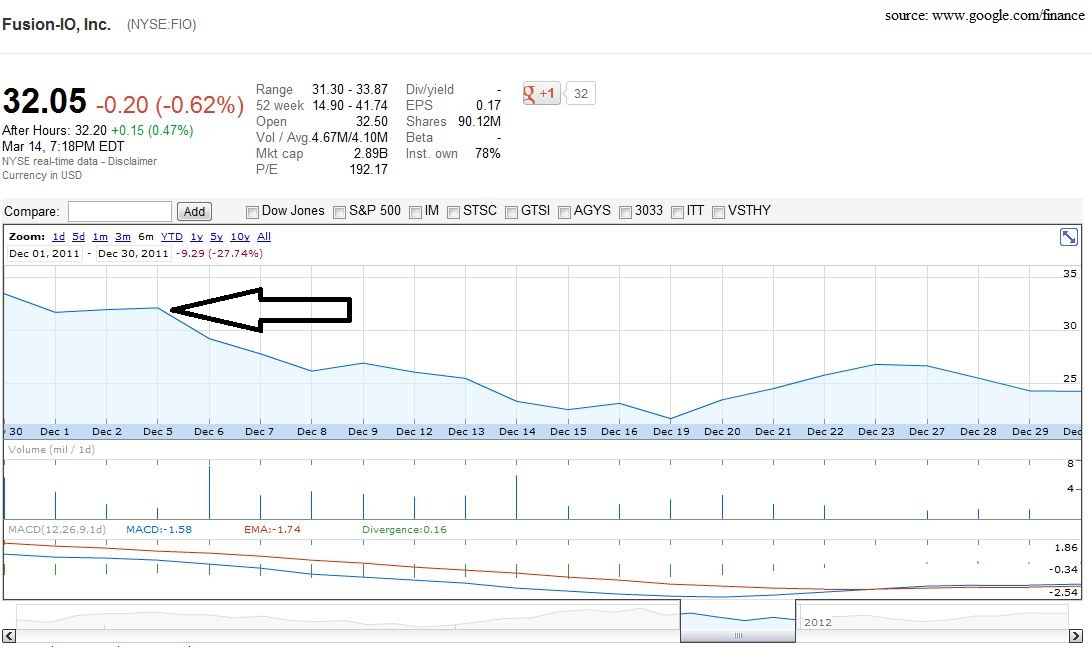

No the company itself does not strike fear in my heart, rather the potential extreme volatility of the stock in the near future. As we have seen with these recent IPOs of tech companies, they initially release a small float, only later to release more shares. This just so happens to flood the market of shares, creating a bit of discomfort for those who believe in the long term potential of said firm. To put things in perspective take a look below when Fusion-io realized shares in mid December.

As the large black arrow indicates, this was a point in which more shares were made available. What is significant is not only the fact that the company began trending down before the second offering, but the downtrend that continued throughout the proceeding month. No matter how bullish an investor is on a company , to take an almost 30% haircut is uncomfortable. Fusion has recently trended back to the level it has fallen from, though it has taken about three months.

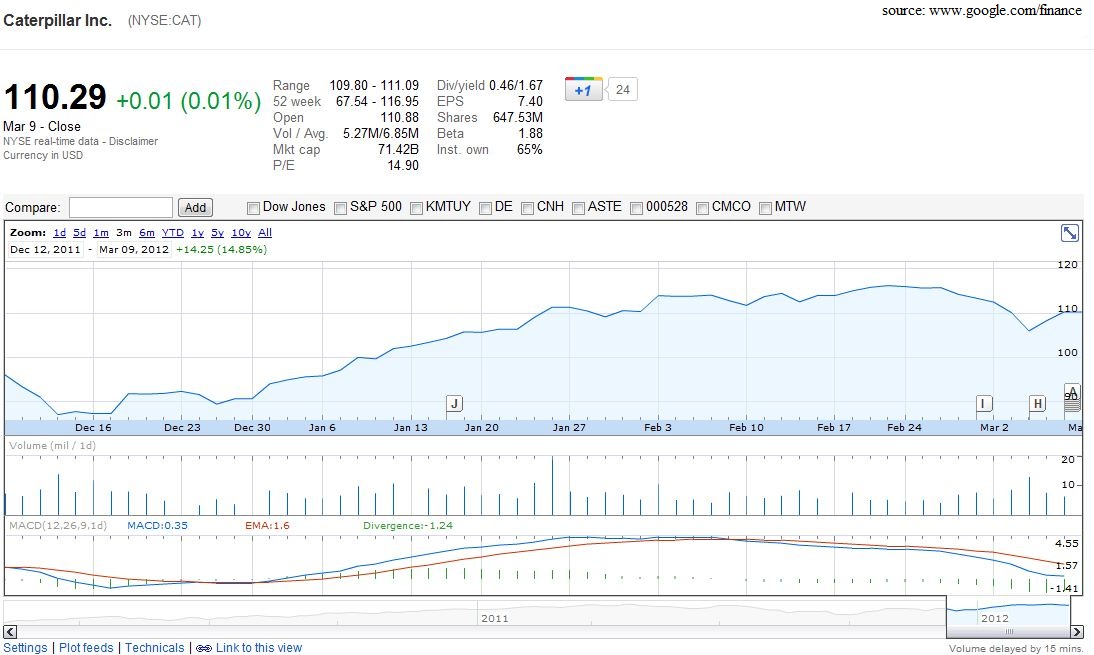

Those who are bullish on Zynga, social media, Facebook and so on know that Zynga has a lot of upside potential. With their continued success in the app world and on Facebook one does not need to question their future dominance. Rather as an informed investor, one must consider the detrimental effects that an oversupply of shares will have on the market. As a recently IPOed company, Fusion supports the case that one should stay away until the shares have comfortably made themselves into the market. Knowing that Facebook’s public offering will create a buzz in social media stocks, and the price of those related to it will skyrocket; Why buy Zynga at $13 when you can get it at $9.

“Not having a clear goal leads to death by a thousand compromises.” – Mark Pincus (Co-founder of Zynga)