Just because you have a pulpit doesn’t mean you are qualified, or for that matter knowledgeable. With the advent of Stocktwits and twiter it is now so easy to plug your stock a caveman can do it. Well that may have been a bit corny but the facts still remain, everyone who has an opinion, no matter who, can share it. Now even the uneducated and ignorant can pass as brilliant. The best of us know that real decisions are calculated and precise and come from a variety of sources. The best trades are made when listening to those who may know more then you rather then those who speak the loudest. Taken at surface value this new voice of the masses can have more cons then pros, but if you break down others opinions, you can get the most out of the social media to boost your trading accounts.

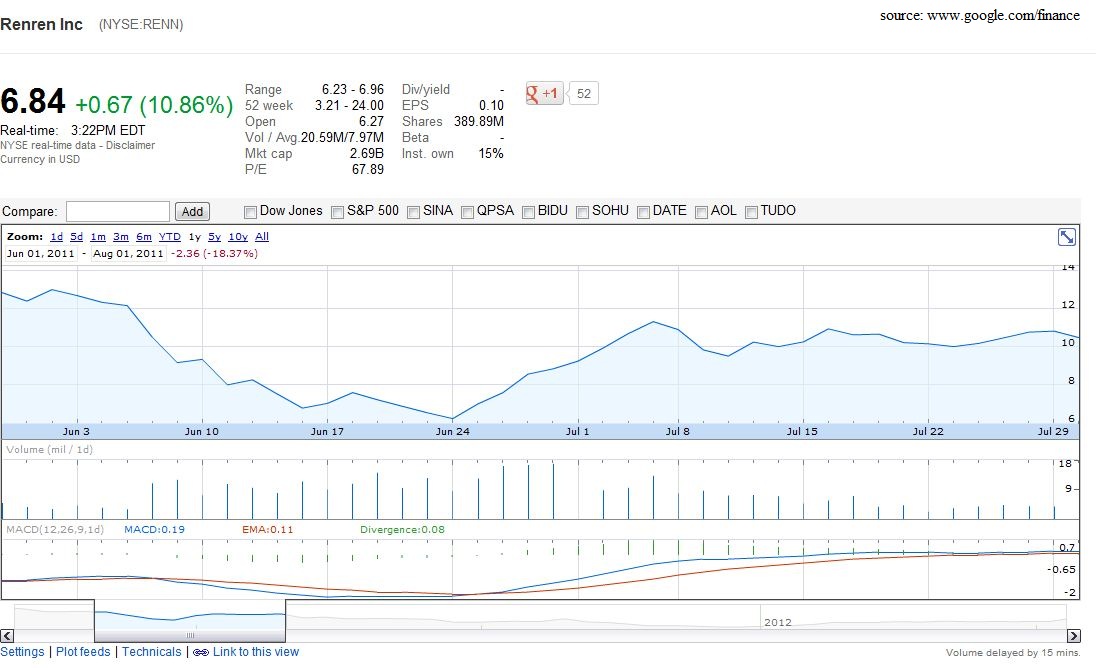

One can see how someones articles or comments align with their holdings very easily, just look at my past articles. When I was very bearish on the market I was a huge supporter of the VIX; in more recent times I am very bullish on social media, just look at my chatter about RENN. What I strive to do when I post articles and opinions, is back this up with some facts. If I am not taking a look at the graphs, I am looking at the basics of the business. What many in the sphere of social media do is neither, and as someone like yourself, obviously trying to be a better trade, you must separate the crap from the knowledge.

My point is simple: consciously or subconsciously everyone in the social media finance world seeks to praise their own positions. Before you let yourself or any of your buddies go running in like a chicken with your head cut off, evaluate. Take a look at what this person has to say currently, see where their opinions come from, look at there past performance. Evaluate what they have to say, never, never, take things at face value. There is always more to the story, and it is your job as a trader to look deeper into that story, before realizing if what is being said should be relished or taken as chatter. More times then not traders are telling you to jump in head first, saying the pool is 10 feet deep and in fact its only 3.