After CNBC’s morning with Warren Buffett last week one could feel very bullish on the economic recovery. My issues do not reside with Warren directly, but rather the public interpretation of his investment calls. To begin with one must understand that Warren deals on a long term basis. He looks at something over a ten year period while most investors are merely searching for returns over a much shorter term. That being said his brilliant investment tactics may not apply to you.

Let’s take a look at Buffett’s Bank of America call last year. After a nice long year Warren’s call has finally come back. Those who followed Warren into the trade may now have broken even after this long, hard, and uncomfortable year. We have no idea where Bank of America will go in the coming months, that’s a concern for another article. But for those investors at home though followed Warren into the BAC trade, your capital could have had a great return elsewhere. Had you bought Apple, Gold, or many other entities, you could have made an easy profit. Instead you looked at an investment that was down almost 50%. From a normal investor standpoint one would rather get returns now and not in the future. Warren is usually right, but often he is right far ahead of the trend, which could cost the normal investor not only his shirt, but his sanity.

Looking at another one of Warren’s big calls, one that many investors have had big questions about, is his lack of investment in gold. Warren, a brilliant man, takes investments back to basics. He is a firm believer in buying a company (or a part of it) and having his initial capital give him a return in growth or a dividend. Those who trade commodities know that this is obviously not how commodities work. Warren fails to realize that commodities prices are based on the limited availability of something, like gold or silver, and the desire of that commodity by the public (or investors). Gold is a simple supply and demand game. Supply is fairly limited and the demand has increased over the past few years. Warren’s failure to look at gold through different lenses; Of gold being in limited quantity and desire increasing for it, have cost him a huge potential return.

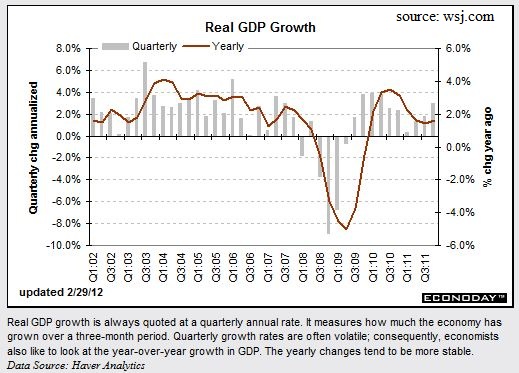

Now that you understand how Warren’s ideologies differ from the mast majority of investors, we can evaluate his most recent call. First off, as we learned through his Bank of America purchase, he sometimes is early, very early. This can cost the small or even large investors lots of money (lost potential returns elsewhere). We have all heard the saying “don’t try to catch a falling knife.” Second Warren fails to realize differing trends, being that he is so set in his ways (he refused to buy gold and missed a great return). With that being said we can now evaluate his most recent call to buy single family homes. There are two fallacies in his argument. First off he may be very wrong in his timing. Warren has been calling a bottom for over a year now. At the beginning of last year many investors thought the bottom was in and played the stock market accordingly. This cost them. In the past Warren has also called things far ahead of time, though he has been right, my money can’t afford to wait, and I am sure yours cant either. The second point of contention may be a little new to many but is worth hearing out. With the recent housing market and financial crash many average Americans may be changing their habits. I see more and more families and young people renting or living in apartments. Americas may be moving into a time where home buying is not what it once was. The desire may be there, but the fear instilled by the last few years as many people saw those around them lose their homes, or lose equity in their homes has change the masses behavior. As I pointed out earlier, Warren often misses profitable trends and he may have missed this new trend away from single family homes. Evaluate these concerns as you run in blind after Warren’s trades.

“Rule No. 1: Never lose money. Rule No. 2: Never Forget rule No. 1.” – Warren Buffett