After this morning it seems as though the world has ceased to be the world we know. Today things seem bad, real bad, but before you capitulate lets take a look at some of the macro data from this past week and attempt to put everything into perspective. As you digest the information in which I am about to share with you, you must also realize that though the beautiful economic data that we immersed ourselves in at the beginning of the year may be faltering, the U.S. remains the best of the worse. Though the rest of the world may be falling apart and many around you capitulating, the U.S. stands to benefit from the misfortunes of those around the world. As the rest of the equities markets will be plagued with horrible economic data in the future, here at home, we seem to be making some progress (or at least not getting worse).

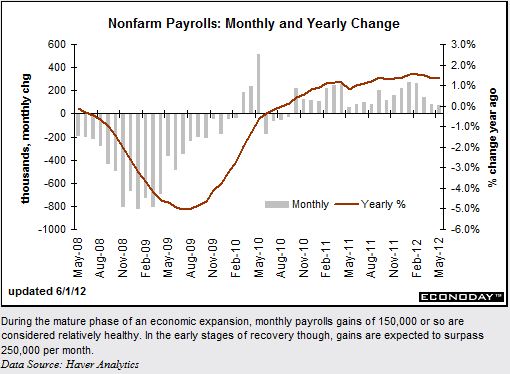

Lets begin with the most important data point, the employment situation. It is by no means as good as anticipated. Though many fail to look at this glass half full, we are nowhere near the grotesque situation we experienced in 2008 and 2009. So what if the recovery takes some extra time, we aren’t falling apart like our neighbors across the pond. We in fact are holding up quite nicely compared to the Europeans who employment situation is horrendous.

If you have read any of my previous work, you will know I am very bearish on the housing market as a whole, as I believe the U.S. housing market has been destroyed for a generation. What I am proud to share with you is that the housing market has finally stopped destroying my property value. No one is getting rich via equity of there home any time soon, but it looks like the months of 10 % losses are something of the past. So to sit there and say things are horrible is laughable. Things were horrible and the stabilization we are witnessing is a blessing that we should relish in.

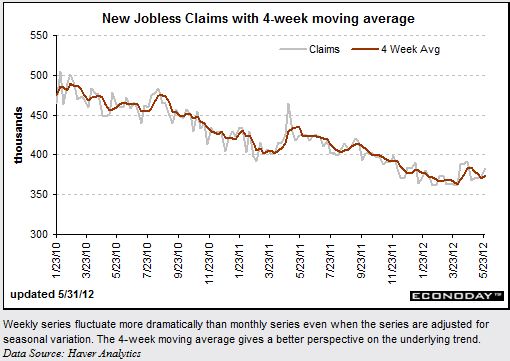

Since jobs seem to be so important, lets take a quick look at the jobless claims. Last year I remember telling my colleagues how I would be much more comfortable with our economic situation if, and only if we get could get jobless under 400k. Look at the above image, we have done that and held nicely. Over the next year if we continue this trend my portfolio will likely have an inverse trend to the above chart.

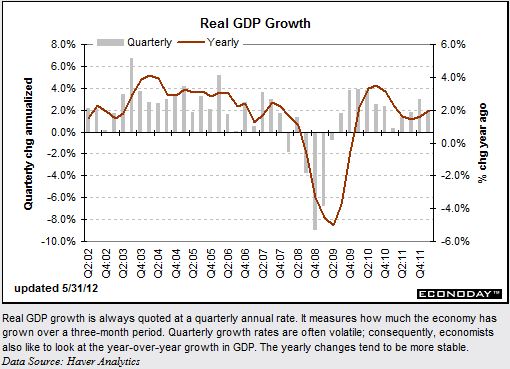

Another point in which the masses seem to be quite preoccupied with, the GDP. Yes the GDP was revised downward a smidgen. The significance of the number 2 seems to be quite overblown in my opinion. We are by no means even looking at stepping in a negative direction. The GDP has fluctuated around this era for a majority of the recovery and will do so for some time. This negative revision suggests things are not on a steep uptrend in which some idiot analysts previously suggested. Though the number suggests things are just fine. Just like all the above data points suggest, things are just fine. Our economic data is not falling apart due to Europe. Though if the ridiculousness continues across the pond the equity markets will continue to fall apart. At the end of the day we will remain the best of the worse here in the United States and this will benefit our equity markets.

A song that sums up the week.