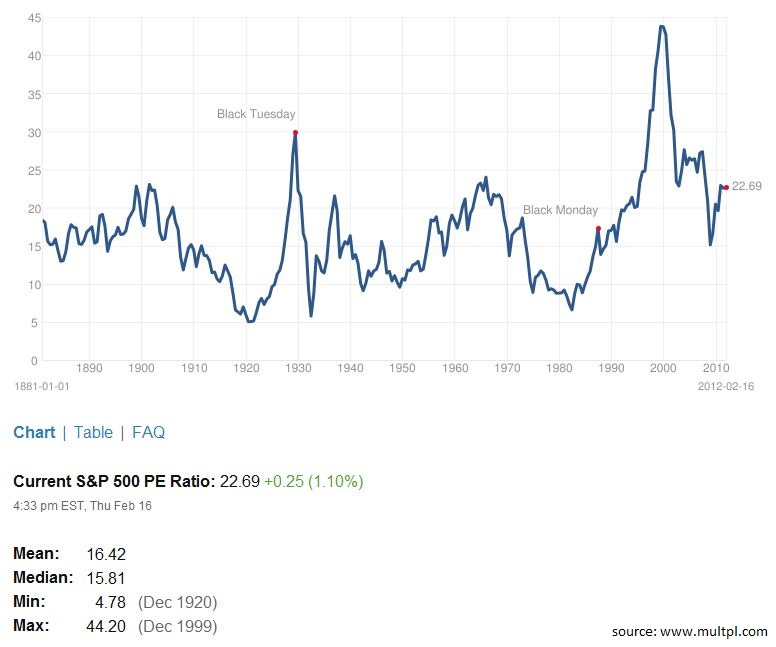

Investors and analyst as of lately are pushing the idea of markets being undervalued here and abroad. These barons of the market use the P/E ratio as one supporting pillar of their argument. This argument is an easy one to buy into due to its appealing story and the recent market uptrend. Though taking a look at the data, a different story unfolds.

During recessionary and recovery times we see P/E closer to 10 then 20. Those claiming that the market is undervalued due to the P/E ratio are misinformed. Taking it a step farther the “Great Recession” in P/E terms does not look to be a great anything, a more dramatic downside should be obvious through the statistics. The recessions of yesteryear had a greater effect on P/E for an extended time period. Comparing current times to those of the great depression (the only similar economic time in history) another pull back in the P/E may be due. To get to the point, the S&P may be dramatically overvalued contrary to what many of the leaders of finance say. The information above suggests a pullback rather then any further momentum upward.